In an era where FinTechs are rapidly reshaping the financial landscape, the mutual fund industry faces a pivotal challenge: nurturing and empowering Independent Financial Advisors (IFAs). It's a call to action for mutual fund companies, particularly their sales and marketing heads, to bolster IFAs with the tools and support they need to thrive. This isn't just a strategy for survival; it's a critical move to ensure the mutual fund industry remains dynamic and client-centric in the face of growing FinTech dominance.

The Crucial Role of IFAs in the Mutual Fund Ecosystem

IFAs are more than just advisors; they are the lifeblood of the mutual fund industry, acting as the crucial link between mutual fund companies and the end investors. They play an indispensable role at the grassroots level, offering personalized advice and fostering relationships built on trust and understanding. In a world increasingly dominated by digital platforms, the human touch provided by IFAs is irreplaceable.

The Threat of FinTech and the Need to Evolve

The rise of FinTechs, with their sleek platforms and automated services, poses a significant threat to the traditional mutual fund model. These tech-driven entities are rapidly gaining market share, and there's a looming risk that they might soon launch their own mutual fund offerings. If mutual fund companies remain complacent, IFAs could face a diminishing role, leading to a loss of that personal touch that is so vital in financial advising.

Empowering IFAs: A Win-Win Strategy

For mutual fund companies, the path forward is clear: empower IFAs with the tools and support they need to succeed. This means providing them with state-of-the-art digital tools, including robust, scalable websites designed to facilitate effective communication and sales. These websites can serve as a platform for IFAs to engage with clients, leveraging tools like WhatsApp for direct, personalized conversations.

The Vital Role of Marketing and Sales Heads in Mutual Fund Companies

The onus falls on the sales and marketing heads of mutual fund companies to champion this cause. They need to recognize the value IFAs bring to the table and invest in their growth. By equipping IFAs with advanced digital tools and training, they can ensure that these advisors remain competitive against FinTech platforms.

Amplispot's Role in Reinforcing IFAs

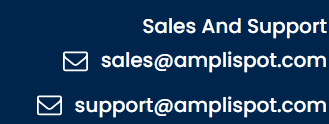

In this endeavor, platforms like Amplispot can be invaluable allies. Specializing in crafting scalable, feature-rich websites, Amplispot can provide IFAs with the digital arsenal they need to enhance their online presence and reach. With such support, IFAs can continue to excel at what they do best—connecting with clients on a personal level and guiding them through the complexities of mutual fund investments.

A Call to Action: Protect and Grow the IFA Community

It's time for mutual fund companies to take decisive action. Protecting and growing the IFA community should be a top priority. By ensuring that IFAs have access to top-notch digital tools and platforms, mutual fund companies can safeguard this vital sector of the industry from being overshadowed by FinTechs.

Embracing Change for a Flourishing Future

In conclusion, the mutual fund industry stands at a crossroads. The choice is clear: either adapt and empower the IFA community or risk losing ground to the ever-growing FinTech sector. By embracing change and investing in IFAs, mutual fund companies can ensure a future where personalized financial advice continues to flourish, benefiting investors and the industry at large. It's a call to action for a collaborative, forward-thinking approach where everyone, from mutual fund companies to IFAs, thrives in synergy.