In the digital landscape, the significance of a well-crafted website for insurance agents cannot be overstated. It's the virtual storefront of your business, often serving as the first point of interaction with potential clients. A compelling and professionally designed website can set the tone for client relationships and significantly impact your business's success.

The Importance of First Impressions

First impressions are crucial, and your website often serves as the initial touchpoint for potential clients. A website that's visually appealing, easy to navigate, and informative establishes a professional image and builds trust from the outset.

Website Design for Insurance Agents

Effective website design for insurance agents involves more than aesthetics; it integrates functionality with a clear understanding of the target audience’s needs. A website should reflect the ethos of your insurance business, emphasizing reliability, expertise, and accessibility.

The Limitations of DIY Website Builders

While DIY website builders like Wix and Squarespace are accessible, they often lack the flexibility and uniqueness required for a standout insurance website. These platforms can limit your ability to fully tailor your site to your specific brand identity, potentially leaving you with a website that looks unremarkable and generic.

The Edge of Professional Web Design

Investing in professional web design services is a game-changer for insurance agents. These experts can create a custom, SEO-friendly website that aligns with your business goals, ensuring a unique online presence that sets you apart in the competitive insurance market.

Key Design Elements for Conversion

A successful insurance website should have clear navigation, responsive design, engaging visuals, and strategic calls to action. These elements guide visitors smoothly through your website, encouraging them to take the desired actions, whether it’s filling out a contact form or making an inquiry.

Content: The Heart of Your Website

Content is the core of your website. Quality, informative content not only helps in client education but also establishes your authority in the insurance field. Regularly updated blogs, FAQs, and detailed service descriptions can significantly enhance your online visibility and client engagement.

Overcoming Website Management Challenges

Managing a website can be daunting, especially with the demands of keeping content fresh and ensuring smooth technical operation. Leveraging professional web management services can alleviate these burdens, allowing you to focus on your core business activities.

Regular Updates: Keeping Your Website Dynamic

A dynamic website with regular content updates is crucial for maintaining relevance and improving SEO rankings. Frequent updates signal to search engines that your website is a current and valuable source of information.

Client Testimonials: The Power of Social Proof

Integrating client testimonials and reviews into your website provides social proof, enhancing credibility and trust among potential clients. These testimonials are influential factors in a client's decision-making process.

Optimizing for Mobile Users

Mobile optimization is imperative in today's digital world. A mobile-friendly website ensures that you provide a seamless experience to the growing number of users accessing the web via smartphones.

SEO Strategies for Enhanced Online Visibility

Implementing effective SEO strategies is key to enhancing your website's visibility and attracting potential clients. Keywords like "how to make a website for an insurance agent" and "insurance agent website optimization" are essential for ranking higher in search engine results.

Utilizing Analytics for Continuous Improvement

Integrating analytics tools allows you to track and understand visitor behavior, providing insights that are critical for refining your website and marketing strategies.

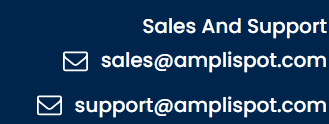

The Role of Amplispot.com in Simplifying Web Design

Platforms like Amplispot.com offer a middle ground between DIY website builders and full-scale professional web design services. They provide the customization and expertise of professional services, tailored specifically for insurance agents looking for a hassle-free yet effective web solution.

Creating an impactful website is vital for insurance agents in today’s digital-first world. A professionally designed website not only enhances your brand’s credibility but also plays a critical role in client conversion and business growth. By focusing on key aspects like professional web design, effective content strategy, mobile optimization, and SEO, insurance agents can develop a strong online presence that resonates with their target audience and drives business success.